Multidimensional Risk Assessments: Methods, Uses and Practices

Navigating the future of risk. Why are two-dimensional risk assessments no longer enough?

Uncertainty and change are the only constant. Risk has become the invisible force shaping the destiny of every organization. Imagine navigating through a storm with a map that only shows two dimensions—flat, simplistic, and missing critical details. That’s what traditional risk assessments offer—a limited view that leaves too much to chance. But what if you could see not just the terrain but the rising waves, the shifting winds, and the hidden currents beneath the surface?

Welcome to the era of multidimensional risk assessments. As we delve into this guide, you'll discover why sticking to outdated, one-dimensional views is no longer just insufficient—it’s dangerous. The complexities of today’s risks demand more than just a glance; they require a full-spectrum analysis that captures the nuances, interdependencies, and rapid shifts in the landscape.

This isn’t just about managing risk; it’s about mastering it. The organizations that thrive in the future will be those that embrace multidimensional thinking, transforming risk from a looming threat into a strategic advantage. Are you ready to elevate your perspective and gain the clarity you need to lead with confidence in an unpredictable world? Let’s dive in.

A. Overview of Risk Assessments

Definition and Importance:

Risk assessment is a systematic process used to evaluate potential risks that could affect an organization, project, or individual. It involves identifying, analyzing, and prioritizing these risks and their risk indicators to inform decision-making processes and determine appropriate risk management strategies. The analytic hierarchy process (AHP) is a structured tool for decision-making in risk assessments, allowing users to perform pairwise comparisons and quantify criteria values to develop risk indicators and prioritize actions based on multiple attributes. Risk assessment is paramount as it forms the foundation of effective risk management across various industries and domains. Without a robust risk assessment framework, organizations may face unforeseen challenges that could significantly impact their operations, reputation, and financial stability. Additionally, declaring any competing financial interests is crucial to ensure transparency and integrity in the risk assessment process.

Common Applications in Various Industries:

Risk assessments are integral to numerous sectors, including but not limited to:

- Finance: Assessing investment risks and managing portfolios to maximize returns while minimizing exposure to market volatility.

- Healthcare: Ensuring patient safety by evaluating risks associated with medical procedures, equipment, and healthcare delivery systems.

- Information Technology: Identifying cybersecurity threats and vulnerabilities, enabling organizations to protect sensitive data and maintain operational integrity.

- Construction: Evaluating workplace safety, environmental hazards, and project timelines to ensure successful and safe project completion.

- Environmental Management: Assessing ecological impacts and natural disaster risks to develop strategies for environmental protection and sustainability.

Learn more how to apply MRA to a variety of industries in this related blog post.

B. Evolution of Risk Assessments

From Simple Models to Complex Frameworks:

The field of risk assessment has evolved from using basic qualitative methods, such as checklists and simple scoring systems, to more complex quantitative and semi-quantitative approaches. Early methods often relied on expert judgment and were limited in scope, focusing on the most apparent risks. As the understanding of risk complexities deepened, more sophisticated frameworks emerged, incorporating statistical analysis, modelling, and simulation techniques. These advancements paved the way for multidimensional risk assessment models, which provide a more comprehensive view of potential risks. The analytic hierarchy process (AHP) has contributed to this evolution by allowing for pairwise comparisons and quantifying criteria values, thus aiding in the development of risk indicators and prioritizing actions based on multiple attributes. Multi-criteria decision models have significantly contributed to this evolution by allowing for the consideration of multiple factors in risk assessments. Advanced methodologies like fault tree analysis are now used in industrial safety to evaluate potential hazards and determine risks based on the likelihood and severity of unwanted events.

The Need for Multidimensional Risk Analysis:

As organizations confront increasingly complex and interconnected risks, the demand for more nuanced risk assessment methods has grown. Traditional two-dimensional models, which focus on likelihood and impact, often fall short in capturing the full spectrum of risks, especially in dynamic environments. Multidimensional risk analysis addresses this gap by incorporating additional factors such as time, vulnerability, and speed of onset. These models enable a deeper understanding of how risks interact, evolve, and impact organizations.

C. Purpose of the Guide

Understanding Different Dimensions in Risk Assessment

This guide aims to provide a comprehensive overview of various risk assessment dimensions, from traditional two-dimensional approaches to more advanced four-dimensional models. We will explore how each additional dimension enhances the understanding of risks and their potential impacts, enabling more accurate and effective risk management.

Practical Applications and Benefits

This guide will help readers identify the most suitable method for their specific needs by examining the practical applications and benefits of each risk assessment approach. We will also discuss best practices for implementing these models in real-world scenarios, ensuring that organizations can effectively manage risks and capitalize on opportunities.

2-Dimensional Risk Assessments

A. Definition and Explanation

What Does 2D Risk Assessment Entail?

A two-dimensional (2D) risk assessment is the most basic form of risk analysis. It typically considers two key factors: the probability of an event occurring and the potential impact if it does occur. This approach provides a straightforward way to categorize and prioritize risks, making it a popular choice for initial risk screening and decision-making.

B. Components of 2D Risk Assessments

Likelihood vs. Impact

The two dimensions of a 2D risk assessment are:

- Likelihood (Probability): The chance that a particular risk event will occur, often expressed as a percentage or on a scale (e.g., low, medium, high).

- Impact: The consequences or effects of the risk event if it occurs, which can be measured in terms of financial cost, time delay, or harm to individuals or assets.

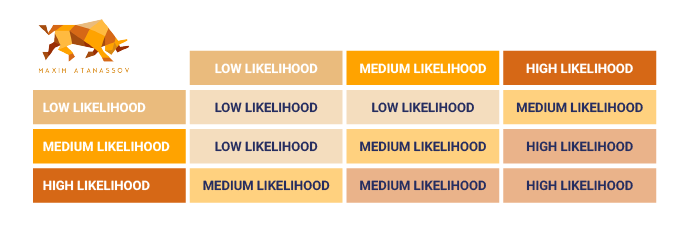

Risk Matrix Explained

A risk matrix is a visual tool used in 2D risk assessments to plot risks based on their likelihood and impact. It typically consists of a grid with likelihood on one axis and impact on the other, allowing for quick categorization of risks into different priority levels.

Example Template: 2D Risk Matrix

C. Advantages of 2D Risk Assessments

Simplicity and Ease of Use

One of the primary advantages of 2D risk assessments is their simplicity. They are easy to understand, implement, and communicate to stakeholders at all levels of an organization, making them particularly useful for quick decision-making and initial risk screening.

Quick Decision-Making Tool

2D risk assessments provide a quick overview of risks, allowing for rapid prioritization and allocation of resources to manage the most critical risks.

D. Limitations of 2D Risk Assessments

Lack of Depth in Analysis:

While useful for basic analysis, 2D assessments can oversimplify complex risk scenarios. They may not capture important nuances or interrelationships between different risk factors, leading to incomplete or misleading conclusions. Additionally, 2D models may not adequately consider environmental aspects, which are crucial for comprehensive risk evaluations in certain industries.

Inability to Capture Complex Risks:

Two-dimensional models struggle to represent risks that have multiple influencing factors or that change dynamically over time. This limitation can be particularly problematic in environments where risks are highly interdependent or evolve rapidly with multiple consequences.

E. Case Studies

Examples from Various Industries:

- Financial Sector: A bank uses a 2D risk matrix to assess the risks associated with different investment opportunities, considering the likelihood of market fluctuations and their potential impact on returns.

- Healthcare: A hospital evaluates patient safety risks using a 2D matrix to prioritize interventions based on the probability of adverse events and their potential impact on patient outcomes.

- IT Projects: A software development team uses a 2D risk matrix to assess risks in the project lifecycle, focusing on the likelihood of delays and the impact on project delivery.

Learn more how to apply MRA to a variety of industries in this related blog post.

F. Best Practices for Implementing 2D Risk Assessments

- Clearly define likelihood and impact scales: Ensure that all stakeholders have a shared understanding of how likelihood and impact are measured.

- Involve relevant stakeholders in the risk identification process: Engage team members with diverse perspectives to ensure a comprehensive risk identification.

- Review and update the risk matrix regularly: Risks and their likelihoods can change over time, so periodic reviews help keep the matrix relevant.

- Use consistent terminology across the organization: Standardized language facilitates clear communication and reduces the risk of misunderstandings.

- Provide training to ensure proper use and interpretation of the risk matrix: Educate stakeholders on how to use it effectively for decision-making.

3-Dimensional Risk Assessments

A. Definition and Explanation

Expanding the 2D Model

A three-dimensional (3D) risk assessment adds an extra layer of depth to the analysis by incorporating a third factor. This allows for a more nuanced evaluation of risks, taking into account additional variables that influence risk dynamics.

Quantitative risk assessment methods are used in 3D risk assessments to provide numerical data that help evaluate the probability and impact of risks more accurately. The analytic hierarchy process (AHP) can be used in 3D risk assessments to prioritize actions based on multiple attributes by performing pairwise comparisons and quantifying criteria values.

Introduction of a Third Dimension

Common third dimensions include:

- Time: How risks may evolve or change over a specific period.

- Vulnerability: The susceptibility of an asset or system to a particular risk.

- Detectability: How easily a risk can be identified or monitored.

Probabilistic risk assessment is a methodology that combines qualitative and quantitative approaches to analyze potential hazards and their probabilities. It aids in making informed decisions regarding safety, health, and risk management.

B. Components of 3D Risk Assessments

Likelihood, Impact, and a Third Dimension

A 3D risk assessment considers:

- Likelihood: The probability of the risk occurring.

- Impact: The potential consequences of the risk.

- Third Dimension: An additional factor such as time, vulnerability, or detectability, which adds context to the risk analysis.

Quantitative risk assessment is a method for assessing and quantifying these risks using tools

C. Advantages of 3D Risk Assessments

Better Understanding of Risk Over Time

By incorporating a time dimension, 3D assessments can show how risks may evolve, allowing for more proactive risk management. This is particularly useful for construction projects or environments where risks change dynamically.

More Detailed and Informed Decision-Making

The additional dimension provides more context for risk evaluation, leading to more informed decision-making and resource allocation. Organizations can better anticipate future risks and take preemptive action.

D. Limitations of 3D Risk Assessments

Increased Complexity

Adding a third dimension increases the complexity of the assessment process and may require more sophisticated tools and expertise to interpret the results effectively.

Potential for Information Overload

The additional information provided by a 3D assessment may be overwhelming for some stakeholders, potentially leading to decision paralysis if not managed properly.

E. Case Studies

Real-World Examples and Applications:

- Project Management: A construction firm uses 3D risk cubes to assess risks throughout the project lifecycle, considering the likelihood of risks, their impact, and how they evolve over time.

- Cybersecurity: A company evaluates cybersecurity threats using a 3D model that incorporates likelihood, impact, and detectability, enabling more targeted and effective security measures.

- Supply Chain Management: A global manufacturer assesses supply chain risks by considering the likelihood of disruptions, their impact, and the time required to recover, ensuring resilience against potential supply chain failures.

F. Best Practices for Implementing 3D Risk Assessments

- Choose a relevant and measurable third dimension: Select a third dimension that adds value to the risk assessment and is aligned with organizational priorities.

- Use visualization tools to effectively communicate 3D risk assessments: Tools such as risk cubes or enhanced matrices can help convey complex risk information in a digestible format.

- Provide training on interpreting and using 3D risk models: Educate stakeholders on how to navigate and interpret the additional complexity of 3D assessments.

- Validate and update the assessment criteria regularly: Ensure that the chosen third dimension and other criteria remain relevant as risks and circumstances evolve.

- Integrate 3D risk assessments into broader risk management processes: Embed 3D assessments within the organization's overall risk management strategy to ensure consistency and comprehensiveness.

4-Dimensional Risk Assessments

A. Definition and Explanation

Adding a Fourth Dimension

A four-dimensional (4D) risk assessment further refines the analysis by incorporating an additional factor, providing a more comprehensive view of complex risk scenarios. This approach is particularly useful for organizations dealing with highly dynamic and interconnected risks.

Common Fourth Dimensions

Potential fourth dimensions include:

- Speed of Onset: How quickly a risk event can occur or escalate.

- Velocity: The rate at which a risk's impact unfolds once it occurs.

- Ability to Anticipate: How easily a risk can be foreseen or predicted.

B. Components of 4D Risk Assessments

A 4D risk assessment typically considers:

- Likelihood:

- Impact

- Time

- Contextual Factors

C. Advantages of 4D Risk Assessments

Comprehensive View of Risk

By considering multiple dimensions, 4D assessments provide a more holistic understanding of risks and their potential impacts. This comprehensive approach helps organizations better prepare for and mitigate complex risks.

Ability to Model Complex Systems and Interdependencies

The additional dimensions allow for more accurate modelling of complex systems and the interdependencies between different risks, enabling organizations to identify and address potential cascading effects.

D. Limitations of 4D Risk Assessments

High Complexity and Resource Intensive

4D risk assessments require significant resources, including advanced tools, expertise, and time to implement effectively. The complexity of the model may also make it challenging to communicate results to stakeholders who are not familiar with the approach.

Need for Advanced Tools and Expertise

Specialized software and skilled professionals are often necessary to conduct and interpret 4D risk assessments accurately. Organizations may need to invest in training and technology to leverage this approach fully.

E. Case Studies

Cutting-Edge Applications in High-Risk Industries:

- Aerospace: A space agency uses 4D risk models to assess the risks associated with spacecraft launches, considering factors such as speed of onset, velocity, and ability to anticipate potential failures.

- Utilities and Electrical Grid: The failure of the electrical grid in Texas serves as a stark reminder of the vulnerabilities in critical infrastructure, underscoring the importance of advanced risk assessment models across various industries. Using a 4D risk multi-dimensional approach is crucial for predicting and preventing the cascading effects that led to the Texas grid's collapse. For further reading, refer to a patent filed by a Chinese utility and our analysis of it.

- Financial Markets: A financial institution evaluates complex financial instruments using 4D risk models, incorporating dimensions such as time, impact, and market volatility to better manage investment portfolios.

- Climate Change: Environmental organizations use 4D risk assessments to model long-term climate risks, considering multiple variables such as time, impact, and the rate of environmental change.

Learn more how to apply MRA to a variety of industries in this related blog post.

F. Best Practices for Implementing 4D Risk Assessments

- Clearly define and justify the selection of the fourth dimension: Ensure that the additional dimension adds value and is relevant to the risk context.

- Invest in appropriate tools and training for conducting 4D assessments: Equip your team with the necessary tools and skills to handle the complexity of 4D models.

- Ensure data quality and consistency across all dimensions: Accurate and consistent data is crucial for reliable risk assessments.

- Review and update the risk assessment model regularly: As risks evolve, so should the assessment model to maintain its relevance and accuracy.

- Communicate results effectively to stakeholders, using appropriate visualizations: Use visual tools and clear explanations to convey the results of the 4D assessment to all relevant parties.

Comparative Analysis

A. Summary of Key Differences

2D vs. 3D vs. 4D: When to Use Each Approach

- 2D: Suitable for simple projects or initial risk screening where only basic risk factors need to be considered.

- 3D: Useful for moderately complex projects or detailed risk analysis where an additional dimension, such as time or vulnerability, provides more context.

- 4D: Ideal for highly complex, dynamic, or critical projects where a comprehensive understanding of multiple risk factors and their interrelationships is required. Additionally, incorporating safety management into 4D risk assessments helps integrate multiple dimensions of potential hazards, facilitating better risk prioritization and decision-making processes.

B. Decision-Making Guide

Selecting the Appropriate Risk Assessment Method for Specific Scenarios

When choosing a risk assessment approach, consider the following factors:

- Project complexity: The more complex the project, the more dimensions may be needed to assess risks accurately.

- Available resources and expertise: Consider the tools, time, and expertise available within your organization.

- Time constraints: Simpler models may be necessary when time is limited, while more complex models may be used when a detailed analysis is required.

- Stakeholder requirements: Tailor the risk assessment approach to the needs and expectations of key stakeholders.

- Nature of risks being assessed: The specific characteristics of the risks in question may dictate the need for additional dimensions in the assessment.

C. Pros and Cons Overview of Economic Risks

A Balanced View of Each Model

- 2D Risk Assessment:

- Pros: Simple, quick, easy to communicate.

- Cons: Limited depth, may oversimplify complex risks.

- 3D Risk Assessment:

- Pros: More nuanced analysis, better representation of risk over time.

- Cons: Increased complexity, may require specialized tools.

- 4D Risk Assessment:

- Pros: Comprehensive analysis, ability to model complex systems.

- Cons: Resource-intensive, may be challenging to communicate results.

Tools and Technologies for Multidimensional Risk Assessments

A. Overview of Popular Tools

Software Solutions and Platforms

- Risk Management Software: Tools like Active Risk Manager and Resolver offer comprehensive solutions for managing risk assessments across multiple dimensions.

- Project Management Tools with Risk Assessment Features: Software like Microsoft Project and Primavera includes risk assessment modules that can be customized to incorporate additional dimensions.

- Spreadsheet-Based Tools: Excel remains a popular tool for risk assessments, with many templates available for 2D, 3D, and 4D models.

- Specialized Risk Modeling Software: Tools like @RISK and Crystal Ball provide advanced simulation and modelling capabilities which are ideal for 3D and 4D risk assessments.

B. Emerging Technologies in Probabilistic Risk Assessment

AI, Machine Learning, and Predictive Analytics in Risk Assessment

- Machine Learning Algorithms for Risk Pattern Recognition: ML can help identify patterns in historical data that indicate potential future risks.

- Natural Language Processing for Risk Identification from Unstructured Data: NLP tools can analyze vast amounts of text data to identify emerging risks.

- Predictive Analytics for Forecasting Potential Risk Scenarios: Predictive models can simulate various scenarios to forecast risks before they materialize.

- AI-Powered Decision Support Systems for Risk Management: AI can assist in making informed decisions by analyzing complex risk data and suggesting optimal strategies. Additionally, occupational safety is a crucial consideration in risk assessment and management, particularly in industrial contexts, to protect workers from potential hazards and minimize risks.

C. Implementation Tips for Fault Tree Analysis

Integrating Tools with Existing Processes

- Assess Current Risk Management Processes and Identify Gaps: Before implementing new tools, evaluate your existing processes to ensure a smooth integration. Fault tree analysis can be used to evaluate potential hazards by systematically identifying and analyzing possible failure points.

- Choose Tools That Align with Organizational Needs and Culture: Select tools that are compatible with your organization’s size, industry, and risk management approach.

- Provide Adequate Training and Support for Tool Adoption: Ensure that all relevant stakeholders are trained in using new tools effectively.

- Establish Clear Guidelines for Tool Usage and Data Input: Standardize how data is entered and analyzed to maintain consistency and reliability.

- Regularly Evaluate Tool Effectiveness and Update as Needed: Continually assess the performance of your risk assessment tools and make updates as necessary.

Future Trends in Risk Assessments

A. The Evolution of Risk Management

From Static Models to Dynamic, Real-Time Assessments

The future of risk assessment lies in dynamic, real-time models that can adapt to changing conditions and provide up-to-date risk insights. These models will enable organizations to respond more quickly to emerging risks and adjust their strategies in real time.

B. The Role of Big Data and Analytics

Enhancing Accuracy and Predictability

Big data and advanced analytics will play an increasingly important role in risk assessment, enabling more accurate predictions and deeper insights into risk patterns. By leveraging vast amounts of data, organizations can identify trends and anticipate risks with greater precision.

C. Potential Developments in 5D and Beyond

What Could the Future Hold?

Future risk assessment models may incorporate additional dimensions such as:

- Interconnectedness: How risks influence and interact with each other, potentially leading to cascading effects.

- Adaptability: The ability of systems to respond and adapt to risks as they evolve.

- Perception: How different stakeholders perceive risks can influence decision-making and risk management strategies.

Conclusion

Selecting the appropriate risk assessment approach is crucial for effective risk management. Organizations should carefully consider their needs, resources, and the complexity of their risk landscape when choosing between 2D, 3D, 4D, or more advanced risk assessment models.

As the world becomes increasingly complex and interconnected, risk assessment methods will continue to evolve. Organizations that embrace multidimensional risk assessment approaches and leverage emerging technologies will be better positioned to navigate uncertainty and capitalize on opportunities in the future.

Appendices

A. Glossary of Terms

- Risk: The potential for an unwanted outcome resulting from an incident, event, or occurrence.

- Likelihood: The probability or chance of a risk event occurring.

- Impact: The consequences or effects of a risk event if it occurs.

- Vulnerability: The susceptibility of an asset or system to a particular risk.

- Velocity: The speed at which a risk’s impact unfolds once it occurs.

- Speed of Onset: How quickly a risk event can occur or escalate.

- Ability to Anticipate: How easily a risk can be foreseen or predicted.

- Known Competing Financial Interests: A declaration made by authors regarding transparency in their research, stating that there are no known competing financial interests or personal relationships that could have influenced the outcomes of their study. This emphasizes the importance of objectivity in their findings.

- Personal Relationships: Disclosing potential conflicts of interest in research by declaring any personal relationships that might influence the credibility of the work presented, particularly in academic and scientific writings. This is crucial for maintaining transparency and integrity in research.

B. Additional Resources

Books:

- "The Failure of Risk Management" by Douglas W. Hubbard

- "Fundamentals of Risk Management" by Paul Hopkin

Articles:

- "A Brief History of Risk Assessment" in Nature

- "The Future of Risk Management in the Digital Era" in Harvard Business Review

Online Resources:

- ISO 31000 Risk Management Guidelines

- COSO Enterprise Risk Management Framework

C. Templates and Tools

Sample Risk Assessment Matrices for 2D, 3D, and 4D Models

- 2D Risk Matrix Template: A simple matrix to evaluate risks based on likelihood and impact.

- 3D Risk Cube Template: A more complex tool to assess risks by adding a third dimension, such as time.

- 4D Risk Assessment Spreadsheet: A comprehensive tool for evaluating risks across four dimensions.

- Risk Register Template: A document to log and track identified risks throughout a project or organization.

- Risk Assessment Questionnaire: A structured set of questions to help identify and evaluate risks systematically.

By providing this comprehensive guide to multidimensional risk assessments, we aim to equip readers with the knowledge and tools necessary to implement effective risk management strategies in their organizations. As the field of risk assessment continues to evolve, staying informed about new approaches and technologies will be crucial for maintaining a competitive edge in an increasingly complex business environment.

Share

Maxim Atanassov, CPA-CA

Serial entrepreneur, tech founder, investor with a passion to support founders who are hell-bent on defining the future!

I love business. I love building companies. I co-founded my first company in my 3rd year of university. I have failed and I have succeeded. And it is that collection of lived experiences that helps me navigate the scale up journey.

I have found 4 companies to date that are scaling rapidly.